Export Loans and Letters of Credit for SMEs: Essential Tools for Global Growth with Meenas Online

In today’s global market, Small and Medium Enterprises (SMEs) drive economic growth. Yet, one of the biggest challenges they face when expanding internationally is securing financing for trade.

Export loans and Letters of Credit (L/Cs) are crucial tools that help SMEs overcome this challenge. These financial instruments empower businesses to expand their reach globally. Meenas Online specializes in offering trade finance services to SMEs, helping them navigate financial barriers and succeed in international markets.

What Are Export Loans and Letters of Credit?

Export Loans for SMEs:

Export loans provide SMEs with the capital needed to produce and ship goods internationally. These loans cover pre-shipment costs like raw materials and production, as well as post-shipment costs incurred after goods are shipped but before payment is received.

There are two types of export loans:

- Pre-shipment loans: Financing provided before goods are shipped, covering production and packaging costs.

- Post-shipment loans: Provided after shipment but before payment, ensuring cash flow until the buyer pays.

Letters of Credit for SMEs:

A Letter of Credit (L/C) is a payment guarantee issued by the buyer’s bank. It ensures the exporter will receive payment once they meet the terms of the agreement. L/Cs are essential in mitigating risks such as delayed payments and fraud, offering SMEs a secure payment method, especially with international buyers.

With an L/C, SMEs can protect themselves from non-payment and fraud, ensuring smoother cash flow. It also helps build credibility with international buyers.

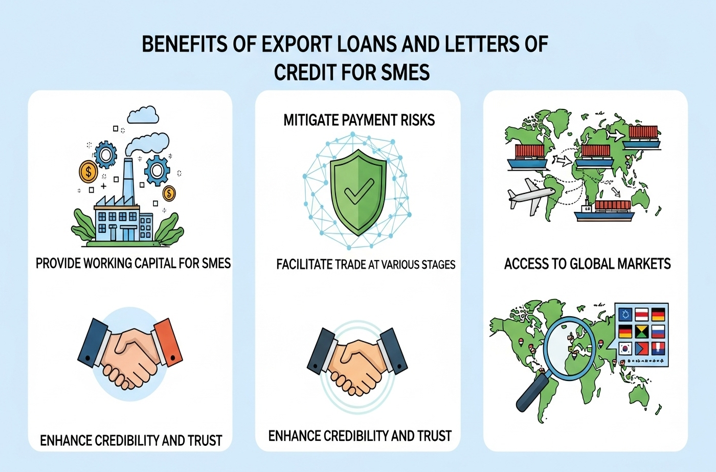

Benefits of Export Loans and Letters of Credit for SMEs:

Provide Working Capital:

Export loans give SMEs working capital, enabling them to purchase raw materials and manage production costs. This ensures business continuity and supports growth.

Mitigate Payment Risks:

L/Cs offer a secure payment mechanism, reducing the risk of non-payment or fraud. SMEs can conduct business with confidence, knowing they’ll be paid as agreed.

Facilitate Trade at Various Stages:

Export loans and L/Cs manage cash flow during both pre-shipment and post-shipment phases. This helps SMEs meet deadlines and market demand without financial strain.

Enhance Credibility and Trust:

Having an L/C boosts trust with international buyers, demonstrating financial stability. This can lead to larger contracts and long-term relationships.

Access to Global Markets:

With export loans and L/Cs, SMEs can enter new markets and increase their global competitiveness. These tools break down barriers to international trade.

How Meenas Online Supports SMEs with Export Financing:

At Meenas Online, we provide comprehensive consultancy services to help SMEs expand globally. Here’s how we assist:

Guidance on Export Loans and Letters of Credit:

Our experts guide SMEs through the entire process of applying for export loans and L/Cs. We offer personalized advice tailored to your business needs.

Connecting SMEs with Financial Institutions:

We connect SMEs with banks and financial institutions offering favorable export financing terms, ensuring they get the best options available.

Simplifying the Application Process:

We streamline the often-complex process of applying for export loans and L/Cs. This reduces administrative hassle and accelerates the approval process.

Risk Mitigation for SMEs:

Our team helps SMEs implement effective risk management strategies, such as trade finance tools and payment guarantees, to reduce the risks of global trade.

Why WAM Saudi 2026 is a Game-Changer for SMEs

Meenas Online is excited to be part of WAM Saudi 2026, where SMEs can explore new business opportunities and expand globally. Attending this influential event provides SMEs with:

Networking with Global Buyers:

Meet buyers and investors from around the world, opening doors to new markets and partnerships.

Valuable Export Finance Insights:

Attend workshops and seminars about export loans, Letters of Credit, and other trade finance solutions to help grow your business.

Showcasing Products to a Global Audience:

Exhibit your products to a global audience and gain visibility. This exposure can attract customers from diverse markets.

At WAM Saudi 2026, SMEs can gain the tools and knowledge to succeed in global markets. Meenas Online will guide businesses every step of the way, ensuring they are well-equipped for international success.

Ready to Take Your Business Global?

Export loans and Letters of Credit are crucial tools for SMEs engaging in international trade. Meenas Online offers tailored export finance solutions, helping businesses navigate global trade challenges. With our expert guidance, SMEs can confidently expand globally, knowing they have the right financial tools in place.

Contact Meenas Online today to start your journey toward global expansion!