Unlocking Capital for Iraqi SMEs: Overcoming Financial Barriers with Meenas online Business Consultancy Services!

The Importance of SMEs in Iraq’s Economy:

Small and Medium Enterprises (SMEs) are the backbone of Iraq’s economy, contributing significantly to employment, economic diversification, and innovation. However, despite their critical role, many Iraqi SMEs face substantial financial barriers that hinder their growth and sustainability. These challenges, such as limited access to capital, inadequate collateral, and low financial literacy, make it difficult for SMEs to secure the necessary funds to expand and thrive.

Business consultancy services, such as those provided by Meenas Online, are essential in helping SMEs navigate these financial obstacles. By offering tailored guidance and support, these services help SMEs unlock their growth potential and access the financing they need.

The Financial Landscape for Iraqi SMEs: Key Challenges

1. Lack of Access to Affordable Financing:

One of the most significant challenges Iraqi SMEs face is limited access to affordable financing. High-interest rates, strict collateral requirements, and the absence of financial products designed for small businesses create barriers to capital. Many SMEs struggle with poor credit histories and insufficient financial records, making it hard to qualify for loans or attract private investment.

For example, private banks in Iraq often require collateral that many SMEs do not possess. Venture capital and angel investors are also reluctant to invest in businesses that lack a clear financial strategy and business plans.

2. Limited Financial Literacy Among Entrepreneurs:

A significant portion of SME owners in Iraq lacks adequate financial literacy. Many entrepreneurs are unfamiliar with how to effectively manage their finances, maintain accurate financial records, or prepare business plans that would make them attractive to investors and financial institutions.

Financial literacy is key for SMEs to manage their cash flow, budgeting, and financial projections, ensuring sustainable operations and improved creditworthiness.

3. The Underdeveloped Financial Infrastructure:

Iraq’s banking sector remains underdeveloped, with limited bank account penetration (only 19% of adults have a bank account). The absence of financial institutions in underserved regions exacerbates the difficulties SMEs face in accessing capital, limiting their growth and innovation potential.

While microfinance institutions serve a small segment of the market, they still struggle to meet the demands of the SME sector. There is a lack of digital financial platforms that can provide more flexible financing solutions to businesses in remote or underserved areas.

Government Initiatives Supporting SMEs in Iraq:

The Iraqi government has taken several steps to support SMEs, recognizing their importance in driving economic growth. Government-backed initiatives designed to facilitate SME financing include:

- The Iraqi Fund for Development (IFD): Provides low-interest loans for business expansion, infrastructure, and operational costs, assisting businesses in key sectors like manufacturing and agriculture.

- Central Bank of Iraq (CBI) Programs: The CBI has launched initiatives offering favorable terms to financial institutions that provide loans to SMEs. These initiatives include government-backed credit guarantee schemes and subsidized interest rates for businesses.

- Microfinance Programs: These programs aim to help informal sector entrepreneurs, providing small loans for businesses to scale operations, especially in rural areas where financial inclusion is limited.

While these government initiatives are vital for addressing some financial barriers, many SMEs remain unaware of these resources or face challenges when applying for these funding programs.

Private Sector Financing: Expanding Opportunities for SMEs:

In addition to government-backed initiatives, the private sector plays a significant role in financing SMEs in Iraq. Some key opportunities include:

- Venture Capital and Angel Investments: Investors are increasingly interested in sectors such as technology, agriculture, and manufacturing. With guidance from Meenas online business consultants, SMEs can present their business plans and financial forecasts to investors, securing the capital needed for growth.

- Crowdfunding: Online platforms that allow businesses to raise funds from a large pool of small investors are gaining traction. Crowdfunding offers an alternative to traditional loans, providing SMEs with flexible and diverse funding options.

- Private Banks and Financial Institutions: Several private banks now offer tailored financial products designed for SMEs, including lower interest rates, leasing options, and flexible repayment terms.

Despite these opportunities, many SMEs struggle to access private financing due to lack of financial literacy, insufficient business planning, and high-risk perceptions among investors.

International Support and Financial Partnerships:

International organizations also play a crucial role in supporting SMEs in Iraq. These organizations provide funding, grants, and advisory services, helping SMEs overcome financial barriers and scale their operations. Some key international partners include:

- World Bank: Provides funding for various programs aimed at improving Iraq’s business environment and facilitating access to capital for SMEs.

- United Nations Development Programme (UNDP): Offers grants and technical support for SMEs in sustainable development sectors, particularly in agriculture, technology, and clean energy.

- European Investment Bank (EIB): Provides loans and investments for infrastructure, renewable energy, and manufacturing projects led by SMEs.

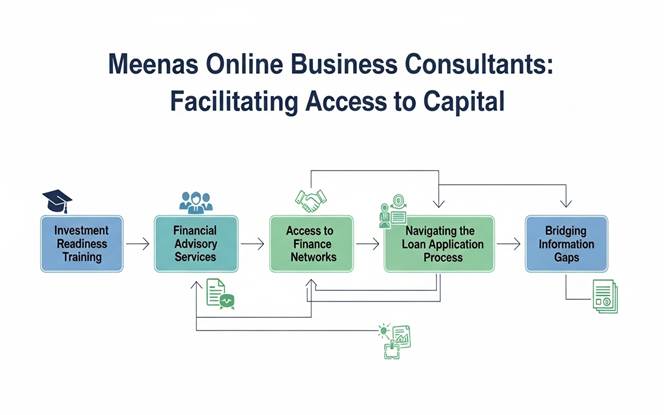

How Meenas online Business Consultants Facilitate Access to Capital:

Business consultancy services help SMEs bridge the gap between them and financing sources. Here’s how Meenas Online aids SMEs in securing funding:

1. Investment Readiness Training:

Meenas online business consultants help SMEs develop robust business plans, improve financial tracking, and present themselves as attractive candidates for investment. Consultants ensure that SMEs understand the loan application process and meet the criteria set by financial institutions.

2. Financial Advisory Services:

Meenas online business Consultancy provides expert guidance on financial management, helping SMEs improve cash flow management, budgeting, and financial reporting. This ensures that businesses remain financially healthy and ready to engage with lenders.

3. Access to Finance Networks:

Consultants leverage their networks to connect SMEs with financial institutions like the Nomou Iraq Fund and Iraq Venture Partners, offering increased opportunities for securing loans and investments.

4. Navigating the Loan Application Process:

Our business consultants guide businesses through the complex process of preparing loan applications, ensuring that SMEs submit accurate and complete documentation that aligns with financial institutions’ requirements.

5. Bridging Information Gaps:

Many SMEs struggle with understanding available financing options. Our consultants provide vital information and training, helping businesses navigate the financial landscape and make informed decisions.

Recommendations for Improving SME Financing in Iraq:

To further improve access to finance for SMEs, the following recommendations should be prioritized:

- Strengthening Financial Infrastructure: Expanding digital financial services and banking options for SMEs can improve accessibility, especially in underserved regions.

- Promoting Financial Literacy: Educational programs should be implemented to increase the financial knowledge of SME owners and their ability to manage business finances effectively.

- Encouraging Formalization: Offering incentives for SMEs to formalize their operations will enhance their eligibility for financing and increase their chances of securing government support.

Empowering SMEs Through Consultancy Services:

Overcoming financial barriers is crucial for the success and sustainability of Iraqi SMEs. Through business consultancy services, like those provided by Meenas Online, SMEs can enhance their financial management practices, improve their creditworthiness, and access the capital they need to grow.

For Iraqi SMEs, partnering with a business consultant offers a path to unlocking capital, expanding operations, and driving economic development. To take the next step in securing financing for your business, contact Meenas Online today for tailored consultancy services that help you access capital, improve financial literacy, and scale your operations.

Join us now!

Contact Meenas Online now to learn how we can help your SME access capital and overcome financial barriers to achieve sustainable growth in Iraq’s competitive market.